DR. YOUSEF PADGANEH

A Banking Risk Management Expert, Academician, and Speaker with Global Experience

(Post Doc., PhD, MBA, BBM, CMA, LIFA)

Success is the result of continues and non-stop efforts in achieving goals.

years of global experinces +20

:About

A senior banking executive in Risk Management and a university professor with more than twenty years of global experience. Leveraging 20+ years of professional experience. Led several risk architecture initiatives and infrastructure implementations including but not limited to Basel II&III, ALM, Operational Risk, IFRS9, Risk Rating Methodology for financial and non-financial risks. Also, An academician with more than 15 years of teaching Risk Management, Corporate Finance & Accounting, and key speaker of several regional risk conferences. In academic life, as a part time activity, I am teaching Accounting, Managerial Accounting, Corporate Finance, Risk Management for undergraduate and postgraduate student since 2002.

KEY AREAS OF EXPERTISE:

• Bank’s Target Operating Model;

• Risk Governance including but not limited to Risk Appetite Framework development & implementation, Establishing Board & Management Risk Committees, and leading First Line of Defense re-designing and implementation (A KPMG Project);

• Basel II & III with strong knowledge of Pillar I and Pillar II, ICAAP (11 years of experience from conceptual framework to full implementation and reporting to regulatory);

• IFRS9 with strong knowledge of Expected Credit Loss;

• Proven record of Model Risk management and Regulatory Stress Testing ( 2 successful regulatory stress test);

• Risk Architecture, extensive experience of implementing several risk infrastructures such as Basel II & III, IFRS9 (From conceptual to fully automated ECL), Moody’s Risk Rating for corporate and SME customers, ALM, Operational Risk, RAROC (From conceptual framework to Operational Model).

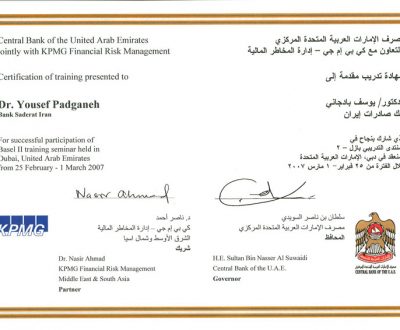

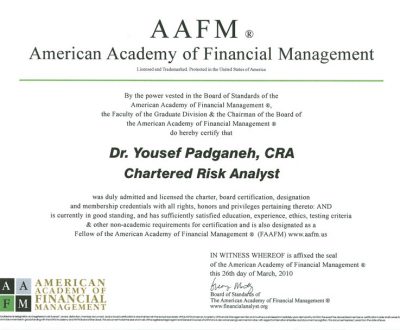

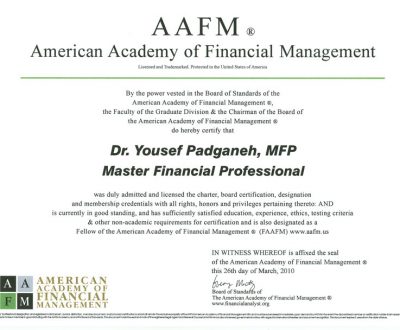

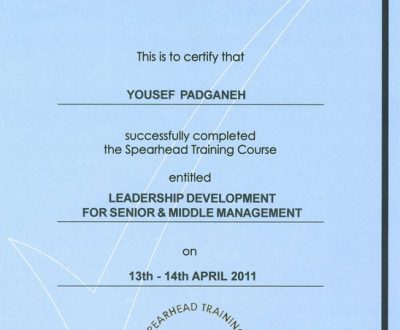

:Certificates

:Educations

• UNIVERSITY DEGREES

– PhD, Business Science, Risk Management- Miskolc University (2013)

– PhD, Banking, Preston University USA, Ajman Campus (2006)

– MBA Financial Since, Shiraz University (2012)

– MBA, Management, AUA, Sharjah UAE (2002)

• UNIVERSITY CERTIFICATES

– Leadership, Harvard Business Publishing, Harvard Business School (2018-2019)

– Post-Doctoral Certificate, Business Management, Walden University USA (2016)

• PROFESSIONAL CERTIFICATE

– CMA AUSTRALIA (2017)

• MEMBERSHIP

– Member of Board Education Committee of PRMIA -2017-2019

– Certified Member of Australian Management Accountants (MID-033016)

– Member of UAE Banks Federations Risk Management Committee (2015-2018)

— Led IFRS9 working group

— Led Basel working group

— Led Risk Management Standards Draft Review working group

:Experiences

SEPTEMBER 2002 – TILL DATE

ADJUNCT PROFESSOR

Teaching Accounting, Managerial Accounting, Corporate Finance, and Risk Management for undergraduate and postgraduate student in various University in UAE and Iran.

MAY 2020 – TILL DATE

CEO AND FOUNDER

YE RISK MGMT AND COST CONTROL PROFESSIONAL SERVICES, DUBAI, UAE

• Leading re-designing of the Target Operation Model for a Regional Bank in UAE

• Provided Risk Management and Corporate Governance training for more than 140 Board and Senior Management in Iran

• Provided technical financial risk training including Basel III.

JULY 2019 – 19 JAN. 2020

HEAD ENTERPRISE RISK MANAGEMENT AND ACTING CHIEF RISK OFFICER

COMMERCIAL BANK INTERNATIONAL (CBI), DUBAI, UAE

OCT 2011 – JULY 2015

HEAD BASEL II, RISK ANALYTICS AND OPERATIONAL RISK

COMMERCIAL BANK INTERNATIONAL (CBI), DUBAI, UAE

MAY 2008 – SEP 2011

TEAM LEADER BASEL II, IMPLEMENTATION AND RISK CAPITAL

COMMERCIAL BANK INTERNATIONAL (CBI), DUBAI, UAE

JULY 2005 – APRIL 2008

RISK MAGER AND HEAD OF BASEL II IMPLEMENTATION

BANK SADERAT IRAN (BSI), DUBAI, UAE

MARCH 2002 – JUNE 2005

MANAGER FINANCIAL CONTROLER

BANK SADERAT IRAN (BSI), DUBAI, UAE

:PUBLICATIONS

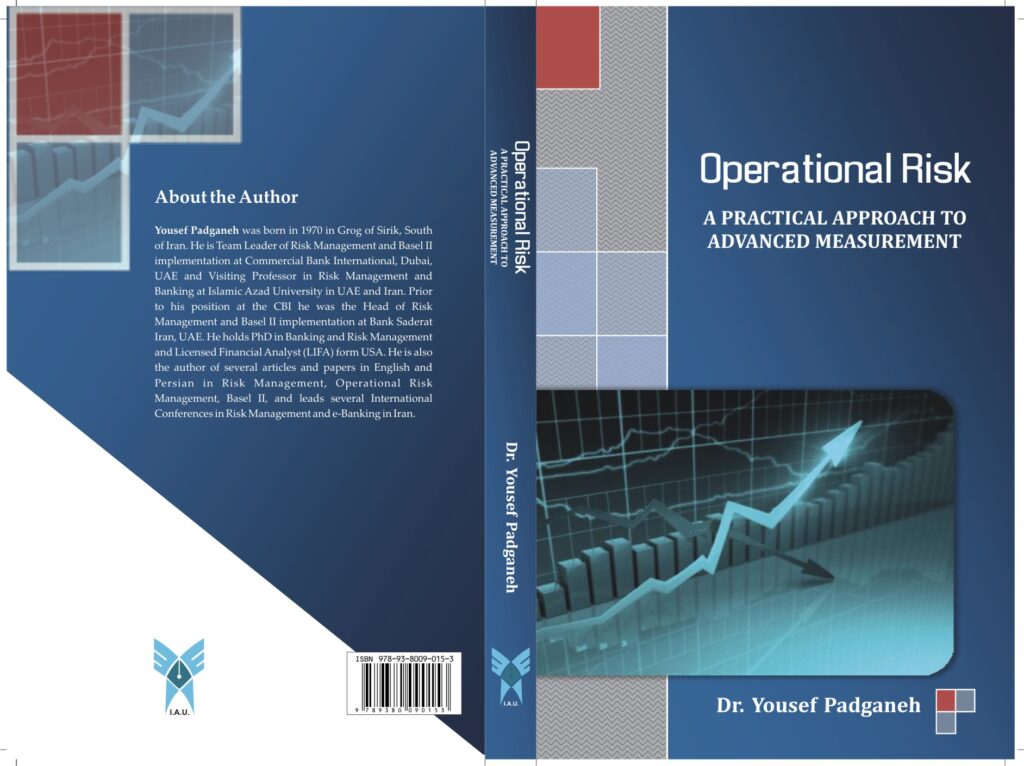

:Book

Operational Risk, A Practical Approach to Advanced Measurement

By: Yousef Padganeh, Ph.D.

ISBN-13 : 978-9380090153

:Articles

– Model Risk Management Lifecycle (Accepted paper, 2019)

– Macroeconomic Credit Risk Stress Test in Commercial Banks (Accepted paper, 2019)

– Credit Stress Testing (2017)

– Basel III impact on UAE banks (2015)

– Loss Distribution Approach: Does it work? (2013) English version by Asia Pacific Journal of Finance and Risk Management)

– An investigation into Advantages and Disadvantages of Loss Distribution Approach (2013) Asia Pacific Journal of Finance and Risk Management)

– Loss Distribution Approach: Does it work? (2013) – (Journal of Credit Review- Hungarian Banking Association -Published in Hungarian Language)

– Operational Risk Management Book – Advanced Measurement Approach (2010)

– Basel II a need for Banking Industry, Bank Quarterly Magazine, No. 43, 2008

– ICAAP, A Practical view, Bank Quarterly Magazine, No. 42, 2007

– MIS & MIT Leadership and Management, Bank Quarterly Magazine, No. 41, 2007

– Risk Management in Banking Industry, Bank Quarterly Magazine, No. 40, 2007

– Basel II and Banking industry, Bank Quarterly Magazine, No. 39, 2007

– Operational Risk Management, Bank Quarterly Magazine, No. 38, 2006 (A professional magazine in banking in Persian language)

– Change Management, Banking and Finance Monthly Magazine, Institute of Baking and Finance, UAE, 2007

– Interview in regards of future of banking industry in UAE, March 2007, Executive Magazine Lebanon.

– Basel II and Banking Industry, A new standard for Banking risk management, International congress in Risk Management, Tehran, Iran, Dec. 2007. (Selected as a top article in banking and panelist of congress)

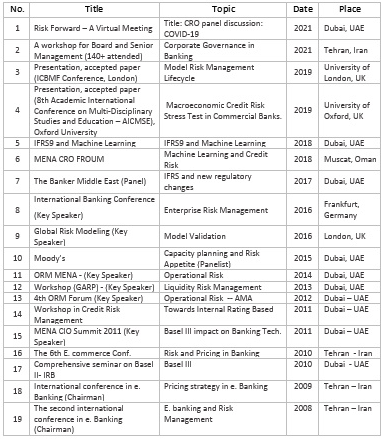

:Confrenc/ Seminar/ Workshop

Attended several risk forums as one of the key speakers.

|

No. |

Title |

Topic |

Date |

Place |

|

1 |

Risk Forward – A Virtual Meeting | Title: CRO panel discussion: COVID-19 |

2021 |

Dubai, UAE |

|

2 |

A workshop for Board and Senior Management (140+ attended) | Corporate Governance in Banking |

2021 |

Tehran, Iran |

|

3 |

Presentation, accepted paper (ICBMF Conference, London) | Model Risk Management Lifecycle |

2019 |

University of London, UK |

|

4 |

Presentation, accepted paper (8th Academic International Conference on Multi-Disciplinary Studies and Education – AICMSE), Oxford University | Macroeconomic Credit Risk Stress Test in Commercial Banks. |

2019 |

University of Oxford, UK |

|

5 |

IFRS9 and Machine Learning | IFRS9 and Machine Learning |

2018 |

Dubai, UAE |

|

6 |

MENA CRO FROUM | Machine Learning and Credit Risk |

2018 |

Muscat, Oman |

|

7 |

The Banker Middle East (Panel) | IFRS and new regulatory changes |

2017 |

Dubai, UAE |

|

8 |

International Banking Conference (Key Speaker) | Enterprise Risk Management |

2016 |

Frankfurt, Germany |

|

9 |

Global Risk Modeling (Key Speaker) | Model Validation |

2016 |

London, UK |

|

10 |

Moody’s | Capacity planning and Risk Appetite (Panelist) |

2015 |

Dubai, UAE |

|

11 |

ORM MENA – (Key Speaker) | Operational Risk |

2014 |

Dubai, UAE |

|

12 |

Workshop (GARP) – (Key Speaker) | Liquidity Risk Management |

2013 |

Dubai, UAE |

|

13 |

4th ORM Forum (Key Speaker) | Operational Risk — AMA |

2012 |

Dubai – UAE |

|

14 |

Workshop in Credit Risk Management | Towards Internal Rating Based |

2011 |

Dubai – UAE |

|

15 |

MENA CIO Summit 2011 (Key Speaker) | Basel III impact on Banking Tech. |

2011 |

Dubai – UAE |

|

16 |

The 6th E. commerce Conf. | Risk and Pricing in Banking |

2010 |

Tehran – Iran |

|

17 |

Comprehensive seminar on Basel II- IRB | Basel III |

2010 |

Dubai – UAE |

|

18 |

International conference in e. Banking (Chairman) | Pricing strategy in e. Banking |

2009 |

Tehran – Iran |

|

19 |

The second international conference in e. Banking (Chairman) | E. banking and Risk Management |

2008 |

Tehran – Iran |

This website was designed with CAMAWEB.